how much should you put down on a $12000 car

15 Ways To Afford Your Dream House - Hippo

Image URL:

Title: 15 Ways To Afford Your Dream House - Hippo

Auto Finance: How Much Should You Put Down to Buy a Car? | Web2Carz

Image URL:

Title: Auto Finance: How Much Should You Put Down to Buy a Car? | Web2Carz

Common Questions:

- What are the ways to afford a dream house?

- How much should I save for a down payment on a house?

- What is the importance of a down payment?

- Can I buy a house with no down payment?

- Are there any government programs available for down payment assistance?

- What are the benefits of making a larger down payment?

- Does the down payment affect the interest rate of a mortgage?

- What are some alternative options to a traditional down payment?

- What is the ideal down payment percentage?

- How long does it typically take to save for a down payment?

- What factors should I consider when determining my down payment amount?

- Can I use home equity as a down payment for another property?

Answers:

-

What are the ways to afford a dream house?

There are several ways to afford your dream house:

- Saving money for a down payment

- Improving your credit score

- Exploring government programs and grants

- Considering a joint mortgage with a trusted partner

- Exploring alternative financing options

- Building a budget and cutting expenses

- Increasing your income through a side hustle or additional job

- Investing in real estate to generate passive income

- Seeking financial guidance from professionals

- Downsizing your current living situation

- Considering rent-to-own or lease-to-buy options

- Negotiating with sellers for a lower purchase price

-

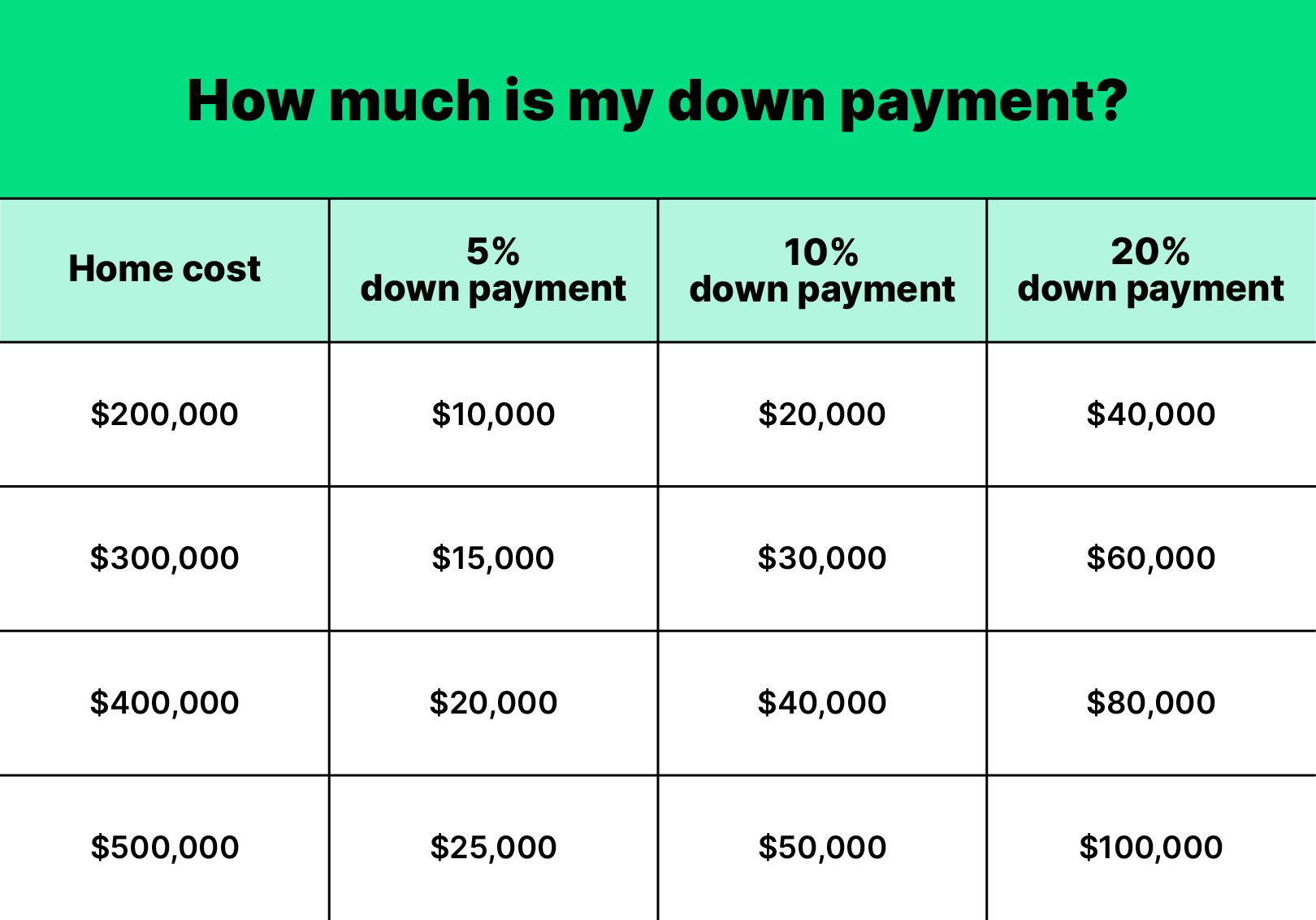

How much should I save for a down payment on a house?

The amount you should save for a down payment on a house depends on various factors, including the purchase price of the house, the type of mortgage you're obtaining, and your current financial situation. It is generally recommended to save at least 20% of the home's purchase price as a down payment to avoid private mortgage insurance (PMI) and secure better interest rates. However, there are options available for smaller down payments, such as FHA loans that require as little as 3.5% down. It's essential to consider your financial goals, monthly budget, and loan options when determining the appropriate down payment amount.

-

What is the importance of a down payment?

A down payment is an upfront payment made when purchasing a house that represents a percentage of the total purchase price. The importance of a down payment includes:

- Building equity: A larger down payment helps you build equity in your home from the start.

- Reducing loan amount: A down payment reduces the loan amount needed, resulting in lower monthly mortgage payments.

- Avoiding PMI: With a substantial down payment, you may avoid the additional cost of private mortgage insurance.

- Securing better interest rates: Lenders often offer lower interest rates to borrowers with a larger down payment, saving you money over the life of the loan.

- Demonstrating financial responsibility: A down payment shows commitment to homeownership and financial stability, making you a more appealing borrower to lenders.

-

Can I buy a house with no down payment?

While it is challenging, it is possible to buy a house with no down payment. Some options include:

- VA Loans: Eligible military personnel can take advantage of VA loans, which often require no down payment.

- USDA Loans: These loans, available in rural areas, may offer 100% financing.

- Negotiating with Sellers: In some cases, sellers may agree to cover the down payment as part of the negotiation process.

- Gift from Family: Family members can provide a gift towards your down payment, helping you avoid paying it out of pocket.

-

Are there any government programs available for down payment assistance?

Yes, there are several government programs available for down payment assistance, including:

- FHA Loans: These loans offer low down payment options, as low as 3.5% for eligible borrowers.

- USDA Loans: Designed for rural homebuyers, USDA loans may offer zero down payment options.

- VA Loans: Available to eligible military personnel, VA loans often require no down payment.

- Local and State Programs: Many local and state governments offer down payment assistance programs to help first-time homebuyers.

-

What are the benefits of making a larger down payment?

Making a larger down payment offers several benefits:

- Lower Monthly Payments: A larger down payment reduces the loan amount, resulting in lower monthly mortgage payments.

- Lower Interest Payments: With a smaller loan amount, you'll pay less interest over the life of the loan.

- No Private Mortgage Insurance (PMI): Avoiding PMI can save you money, and a larger down payment may help you eliminate this expense.

- Better Loan Terms: Lenders often provide more favorable terms, such as lower interest rates, to borrowers with larger down payments.

- Equity and Home Value: A larger down payment allows you to build equity in your home more quickly and potentially increases your home's value.

-

Does the down payment affect the interest rate of a mortgage?

Yes, the down payment can affect the interest rate of a mortgage. Lenders often provide lower interest rates to borrowers with larger down payments. By making a substantial down payment, you demonstrate financial responsibility and lower the risk for lenders, resulting in more favorable interest rates. However, it's essential to consider other factors, such as credit score and loan terms, when determining the interest rate for your mortgage.

-

What are some alternative options to a traditional down payment?

Some alternative options to a traditional down payment include:

- Gift Funds: Family members or close relatives can provide gift funds to assist with the down payment.

- Down Payment Assistance Programs: Various organizations offer down payment assistance programs to help homebuyers with limited funds.

- Community Seconds: These programs allow borrowers to obtain a second mortgage to cover part or all of the down payment.

- Homebuyer Grants: Some grants are available for first-time homebuyers, which can be used towards the down payment.

- Sweat Equity: Some homeownership programs offer the option to contribute labor instead of a cash down payment.

-

What is the ideal down payment percentage?

The ideal down payment percentage varies based on personal preferences, financial circumstances, and loan options. While a traditional down payment is typically 20% of the home's purchase price, many lenders accept lower amounts, such as 10% or even 3.5% for FHA loans. It's recommended to save as much as possible for a down payment to reduce loan amount, monthly payments, and avoid additional costs such as private mortgage insurance.

-

How long does it typically take to save for a down payment?

The time it takes to save for a down payment varies for each individual and depends on factors such as income, expenses, and savings habits. It is recommended to create a budget, cut expenses, and set aside a portion of your income specifically for saving towards a down payment. With discipline and proper financial planning, it is possible to save for a down payment within a few years or even sooner.

-

What factors should I consider when determining my down payment amount?

When determining your down payment amount, consider the following factors:

- Monthly Budget: Calculate how much you can comfortably afford to spend on a monthly mortgage payment.

- Loan Options: Different types of loans have varying down payment requirements and may influence your decision.

- Additional Costs: Consider the associated costs of homeownership, such as closing costs, property taxes, and maintenance expenses.

- Emergency Fund: Ensure you have an adequate emergency fund set aside, separate from your down payment savings.

- Future Financial Goals: Consider how a larger or smaller down payment may impact your ability to achieve other financial goals.

-

Can I use home equity as a down payment for another property?

Yes, it is possible to use home equity as a down payment for another property. This can be done through various methods:

- Home Equity Loan: You can take out a home equity loan, also known as a second mortgage, on your current property to obtain funds for a down payment.

- Home Equity Line of Credit (HELOC): A HELOC allows you to borrow against the equity in your home, providing access to funds for a down payment.

- Cash-Out Refinance: Refinancing your current mortgage and taking cash out from the equity can provide the funds needed for a down payment.